Worldpay Innovation FocusTransform your software platform

Embedded payments and finance expand

Software platforms in the UK and Canada have the ability to seamlessly embed secure, scalable payment processing and financial services directly into their applications. Enable your merchants to offer more options to their consumers for enhanced experiences.

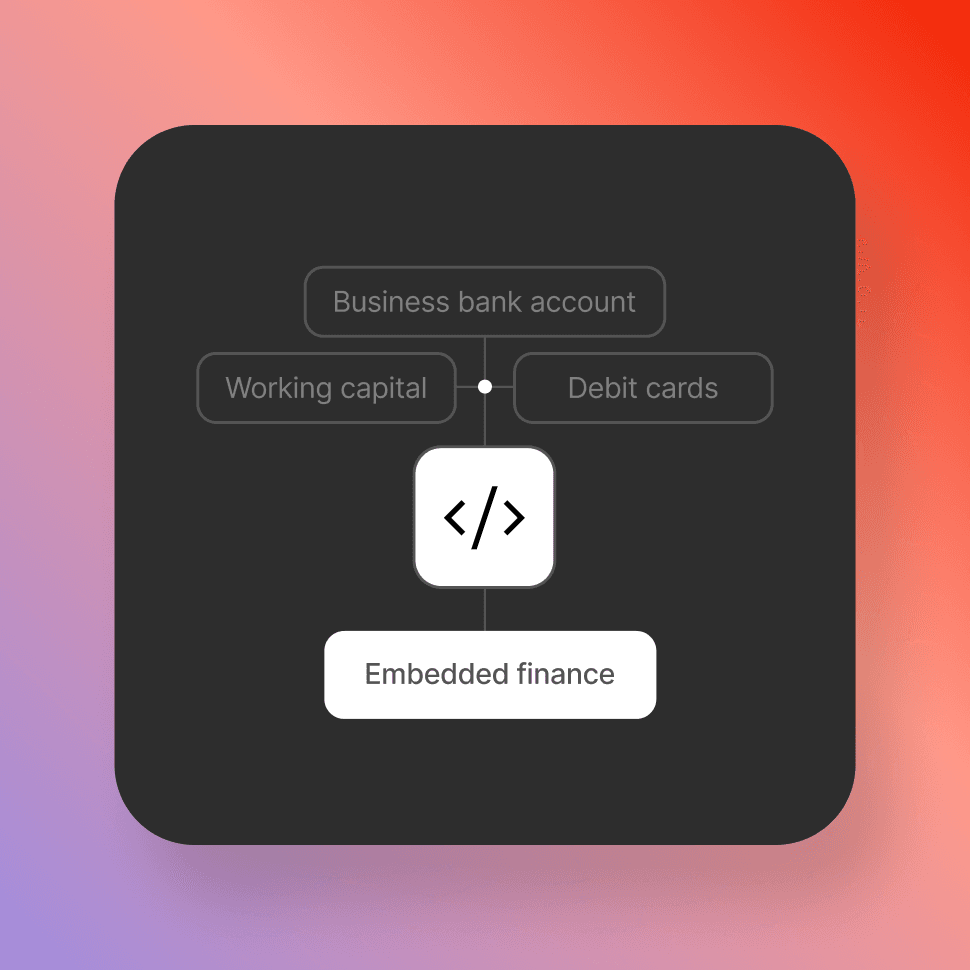

Power every financial touchpoint

Pre-built embedded finance components make it fast and easy for software platforms to deliver market-leading financial services. Integrated directly into your applications, you can deliver working capital, business banking accounts, and debit cards out of the box - no heavy lift, major investment or extra resources. With one API call and minimal setup, your customers can access financial tools quickly to unlock new growth opportunities. Turn your platform into your users' everyday financial hub, driving loyalty and growth.

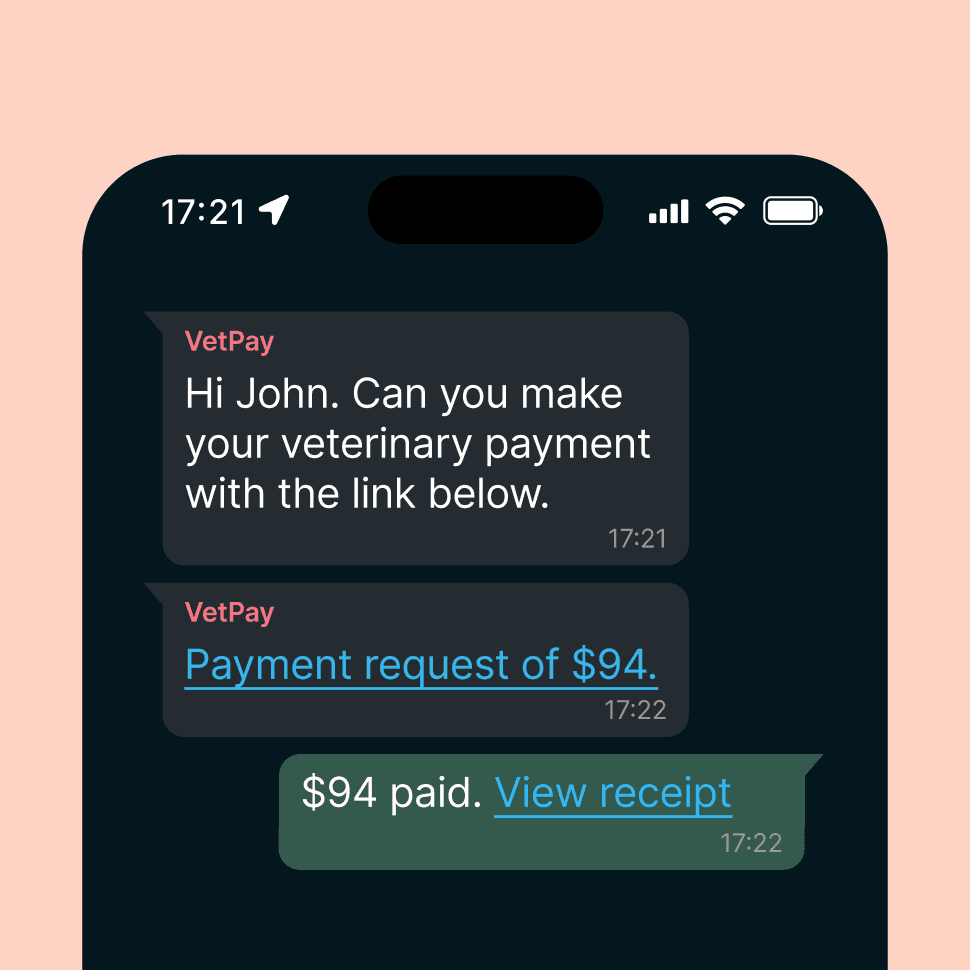

Faster payments, one text away

Enable your merchants to offer a faster, frictionless way to get paid. With Text-To-Pay, merchants can send secure, one-click payment links via text message. This service accelerates cash flow by reducing invoice payment times from an average of 49 days to just 3 days in sectors like healthcare.

Tokenise payments, reduce risk

Payment tokenisation replaces sensitive card details with secure tokens that work across every channel - online, in-store, or mobile. It helps your merchants reduce compliance burden, strengthen data security and support recurring or one-time payments.

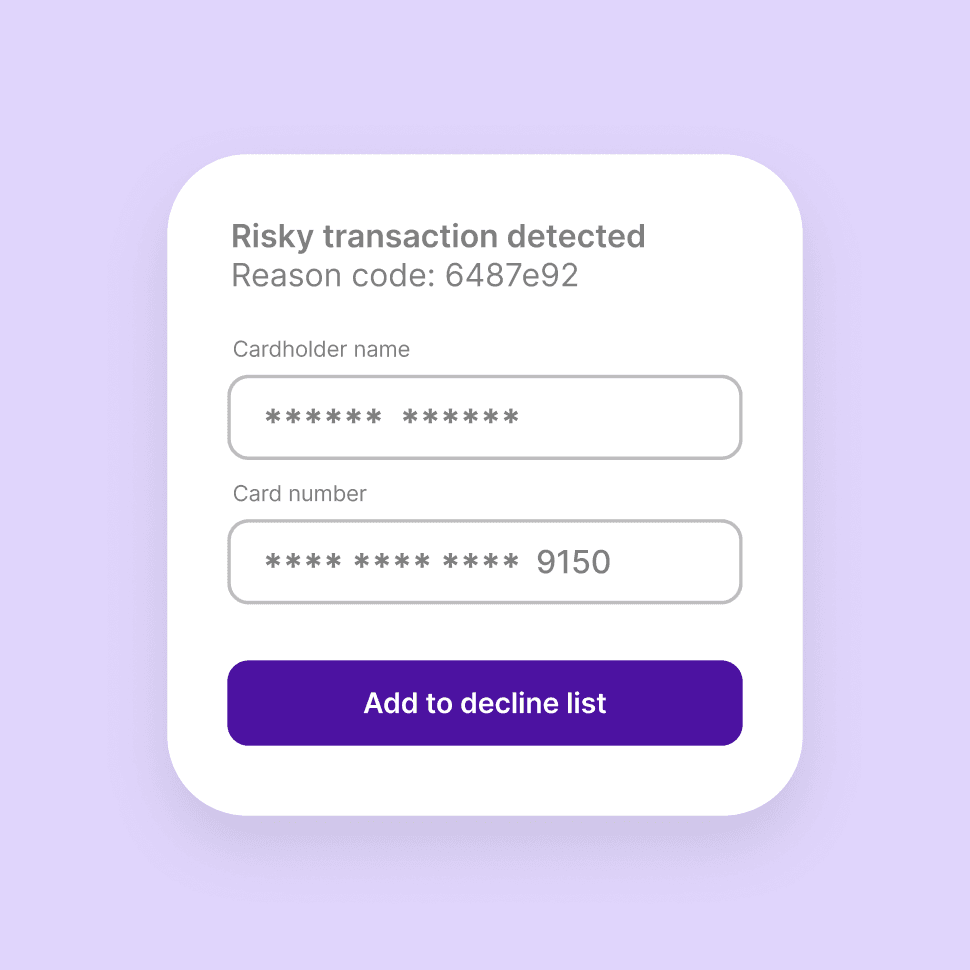

Stop fraud before it strikes

Built-in, real-time fraud protection for US-based platforms combines machine learning and expert monitoring to stop fraud before it happens. By reducing false declines, platforms can help merchants safeguard transactions, boost approvals and create seamless experiences.

Loyalty that pays off

Deliver more value to your merchants with an embedded loyalty and gift service, directly from your platform. Fully customizable and easy to integrate, it helps merchants reward repeat customers, manage gift transactions safely across channels, and track performance with the help of built-in analytics. The result? Deeper customer engagement and higher revenue potential.